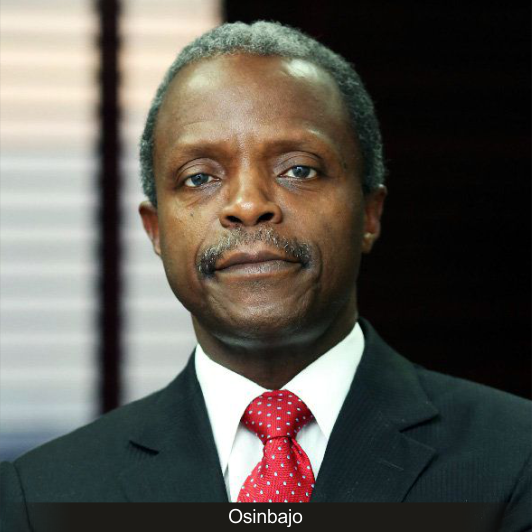

The Vice President, Prof. Yemi Osinbajo, today disclosed that the number of tax-paying Nigerians had increased from 14 million in May 2017 to 19 million this year.

Osinbajo, who gave the hint at the 2018 Annual Tax Conference of the Chartered Institute of Taxation of Nigeria (CITN) in Abuja, said that as of December 2017, only 943 Nigerians paid self-assessed taxes of less than N1 million.

The Vice President expatiated: “Earlier, I noted that as of May 2017, only 14 million economically active Nigerians pay taxes. I am pleased to note that the number is now in excess of 19 million and still growing.

“This means that efforts led by the Federal Inland Revenue Service in collaboration with many of the states inland revenue services have already added more than five million new taxpayers to the tax base.

“But there is still a lot of work ahead of us; as Nigeria races to catch up with the rest of the world in terms of tax compliance we all have a role to play in this’’, he added.

Osinbajo pointed out that tax issues were not exciting to anyone, adding that there is the debate about whether one should pay taxes or enjoy dividend of governance.

He, however, explained that in reality, it should not be debated as compliance and good governance should exist be complementary being inseparable components of a social contract that binds citizens and government.

The Vice President, while noting that the country’s tax-to- GDP ratio remains now at six per cent, explained that given the current efforts at tax reforms at national and sub-national levels, the tax ratio to the GDP could rise to 15 per cent in 2020.

He pointed out that with the current initiatives of the present administration to improve the efficiency of the nation’s tax system, including the Voluntary Assets and Income Declaration Scheme (VAIDS), leakages are being plugged with the system.

According to him, the administration had taken steps, through domestic policy measures and international agreements, to prevent corporate and individual taxpayers from evading tax, including the multi-national companies.