Alcohol Manufacturers Reject 500% Hike On Excise Duty

The Distillers and Blenders Association of Nigeria (DIBAN) today rejected the Federal…

FG Recovers N30bn From VAIDS, Forecasts 40M Taxpayers By 2019

The Chairman of the Federal Inland Revenue Service (FIRS), Babatunde Fowler, today…

BudgIT Charges Lagos State Govt To Comply With FOI Act

BudgIT Nigeria, a civic tech organisation working on fiscal transparency, has demanded…

Airline Operators Threaten To Stop VAT Remittances

Indigenous airlines in the country have threatened to stop remittance of Value…

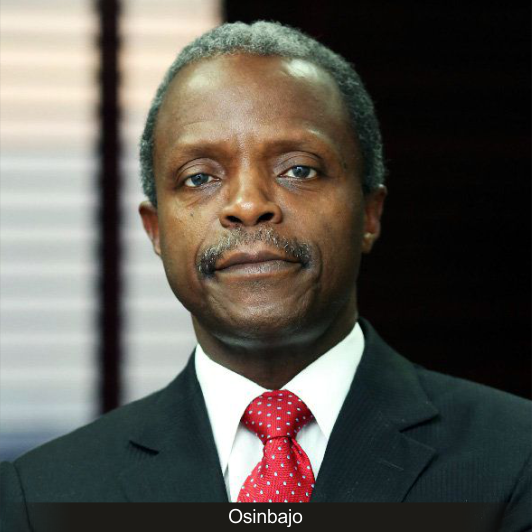

FG Reports 51% Growth In Tax Revenue

The Vice President, Prof. Yemi Osinbajo, today disclosed that the country’s tax…

Nigeria Generates N269.79bn VAT In Q1

The total Value Added Tax (VAT) generated by governments in the first…

Marketers Seek Removal Of VAT On Cooking Gas

The Nigerian Association of Liquefied Petroleum Gas Marketers (NALPGAM) today called on…

We’ll Intensify Tax Drive To Sustain Economic Growth – Adeosun

The Minister of Finance, Mrs. Kemi Adeosun, today restated the present administration’s…

Tax-Compliant Nigerians Rise To 19Mn – Osinbajo

The Vice President, Prof. Yemi Osinbajo, today disclosed that the number of…

Osun Revenue Service Seals OAU Over N1.8bn Unremitted Taxes

As part of its current revenue generation drives, the Osun State Internal…