….as FIRS, LIRS sign MoU on joint tax audit, investigation

Lagos State Governor, Mr. Babajide Sanwo-Olu, has stressed the need for all revenue agencies in the country to work together by widening the tax net to raise the country’s tax to GDP ratio.

The governor gave this charge on Monday during the signing of a Memorandum of Understanding (MoU) on the exchange of information and implementation of joint tax audit and investigation exercise between the Lagos State Internal Revenue Service (LIRS) and Federal Inland Revenue Service (FIRS) in Lagos.

He pointed out that Nigeria had maintained an unimpressive tax-to-GDP ratio of between 6% to 8% over the past few year despite the improved revenue collections by both FIRS and LIRS, adding that the failure to increase tax collection nationwide has put pressure on the nation’s resources and created an imbalance in government expenditure.

Sanwo-Olu stressed the need for the country to operate at the same level as other nations within sub-Saharan Africa (SSA) by achieving between 14% and 15% in tax to GDP ratio in order to support the government’s development programmes and improve accountability.

He said: “We have just witnessed an epoch-making ceremony between the Federal Inland Revenue Service and Lagos Inland Revenue Service. This collaboration did not just happen by chance; it is a conversation we started about a year ago with the chairman of FIRS when both parties reviewed their successes and limitations. It was clear there was a need for a relationship to be consummated.

“Both FIRS and LIRS have been breaking records of their tax collection and administration yearly, but this is not enough. We have an unimpressive tax-to-GDP ratio, which ranges between six and eight per cent; this is totally unacceptable.

“Studies have shown that there would be better service delivery to the citizens and improvement in the efficiency of tax collection when the two agencies work together. The cost of tax collection would be reduced, we would see better customer satisfaction and more resources would be generated for the Government to deliver more dividends of democracy.

“For us as a State, we are humbled by this collaborative effort and we believe our citizens will be the ultimate beneficiaries of this initiative. The MoU is in the best interest of the public, as it affirms the reason why we need to come together and strengthen the cordial working relationship between the two agencies”, the governor added.

Speaking at the signing event, the Executive Chairman of LIRS, Mr Ayodele Subair, explained that the purpose of the agreement was to foster greater collaboration between the two agencies and promote the smooth operation of activities not only for the benefit of tax authorities but for improved service delivery for taxpayers.

Subair expatiated: “Notwithstanding its inclusion as a fundamental obligation of every Nigerian citizen pursuant to Section 24 (f) of the 1999 Constitution as amended, filing of annual income tax returns or payment of tax therefrom is not an issue that citizens are keen on. Nonetheless, citizens expect to have direct benefit of democracy and good governance without remembering that the most reliable and sustainable means of domestic resource mobilization for government expenditure is taxation.

“There is no reason to debate the above as it has been established that tax compliance and good governance are expected to co-exist as the undividable social contract that binds citizens and governments anywhere in the world. Therefore, citizens and governments are expected to fulfill their end of the bargain in achieving a balance.

“Today’s signing of this Memorandum of Understanding is in furtherance of the above bargain on the part of the tax authorities. While this initiative of a joint audit is not a new one, it is peculiar because it comes at a time when our dear nation struggles with the dwindling oil receipts and other economic woes which have affected the tax-to-GDP ratio which is currently adjudged as the lowest globally, standing at approximately 6%, compared to neighboring countries which average between 15 – 25%., Subair added.

According to him, some of the expected achievements from this collaboration between both tax authorities include a reduction of compliance costs for taxpayers; improved transparency in the tax administration process, which will impact tax disputes, incidences and reconciliation; reduced administration costs for both tax authorities; and elimination of hiding place for recalcitrant taxable persons and entities.

In his own remarks, FIRS’ Executive Chairman, Mr. Muhammad Nami, said the essence of the collaboration between the FIRS and LIRS was to enable the two agencies to carry out joint projects together, secondly, in the course of its investigations, they both work as a team while the third and most important reason was to ensure automatic exchange of information which would enable the agency get a bigger data for seamless tax administration.

He assured: “We will work together as a team during the investigation and have an automatic exchange of information. With this, we will be able to carry out our mandate seamlessly.

“As part of the joint operation, we will be able to implement presumptive tax as far as issues of tax administration are concerned”, the FIRS’ chairman added.

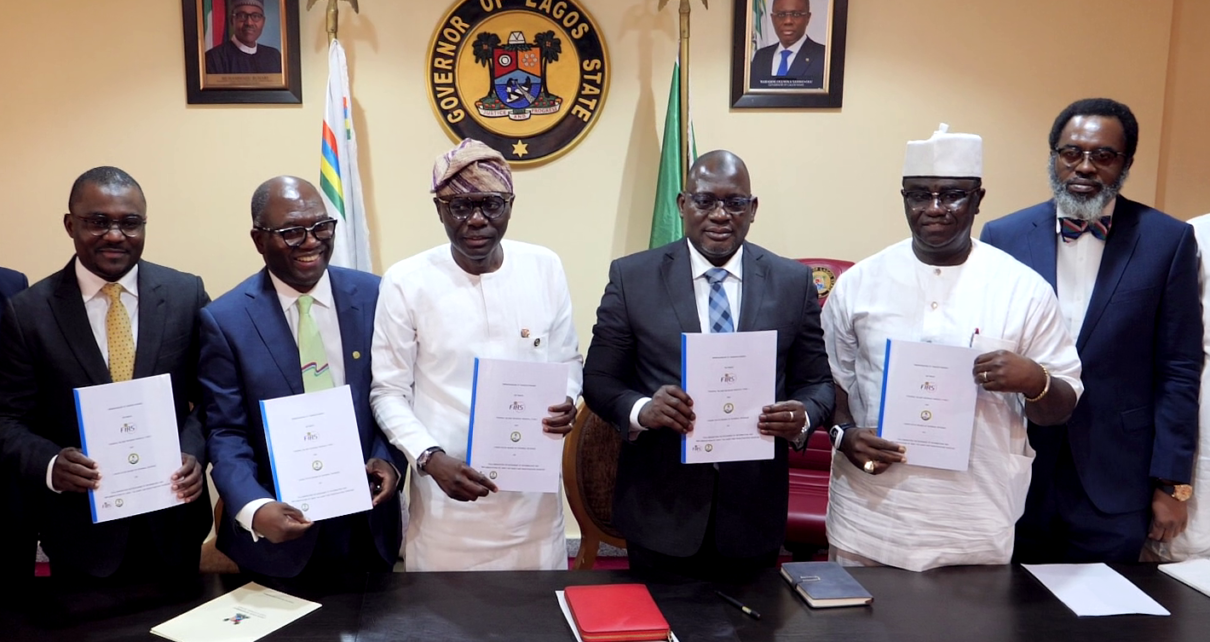

Photo Caption

L-R: Lagos State Commissioner for Finance, Dr Rabiu Olowo Onaolapo; Executive Chairman of Lagos State Internal Revenue Service (LIRS), Mr Ayodele Subair; Lagos State Governor, Babajide Sanwo-Olu, Executive Chairman of Federal Inland Revenue Service (FIRS), Muhammad Mamman Nami; Minister of State for Finance, Budget and National Planning, Mr. Clement Agba and Lagos state Attorney-General and Commissioner for Justice, Mr. Moyosore Onigbanjo (SAN) during the signing of MoU between the two revenue services at the Lagos State House, Marina on Monday, February 6, 2023