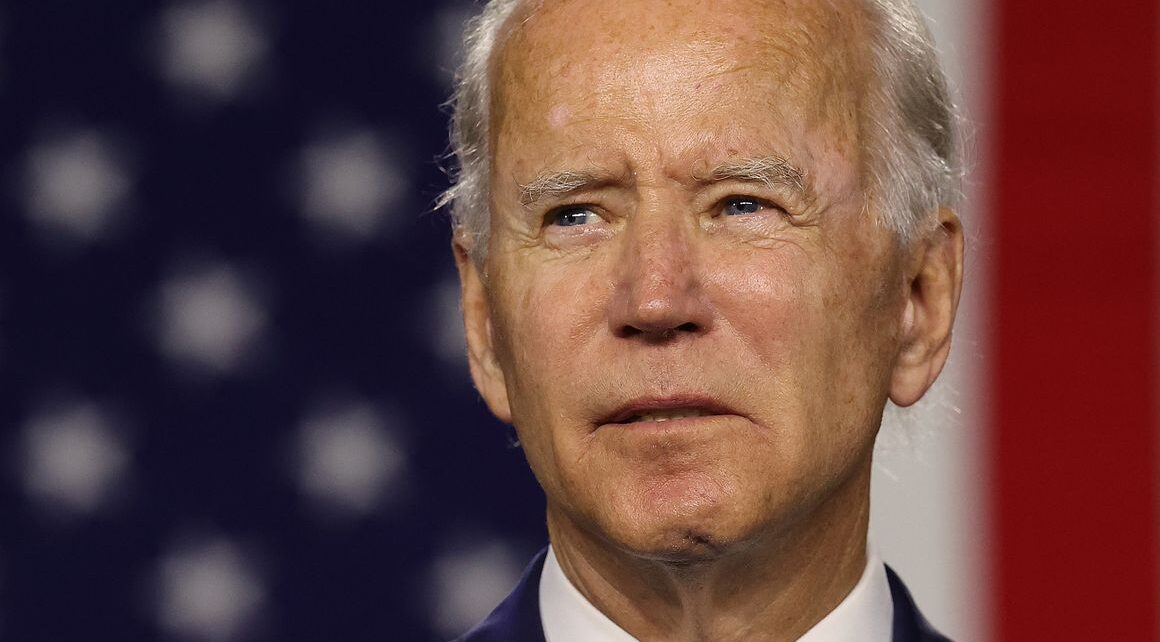

The President Joe Biden-led government is set to begin the payment of Child Tax Credit to low and moderate income households.

The Child Tax Credit, which is a key component of Joe Biden’s American Rescue Plan, is slated to commence first-ever monthly cash payments on July 15, when the IRS will begin sending checks to eligible families with children ages 17 or younger.

According to news reports monitored by our correspondent on Tuesday, the new enhanced credit is part of the U.S. government’s effort to use the tax code to help low and moderate income families weather the ongoing challenges of the Covid-19 pandemic.

The enhanced Child Tax Credit (CTC) is the latest use of the tax code by government to deliver money into millions of household bank accounts, following three rounds of direct stimulus checks that were in form of tax rebates.

President Biden’s American Rescue Plan authorized the expansion of the CTC, which has existed since the late 1990s, to more quickly provide monthly checks to beneficiaries.

According to the Rescue Plan, the expansion increased beneficiaries’ credit from $2,000 to $3,600 for each child under 6 or $3,000 for children ages 6 to 17.

In addition, it also makes the CTC “refundable,” which implies that people can get it even if they don’t owe federal income tax, which will increase the number of low income households that qualify for the payments.

The CTC has an income cutoff of $75,000 for single taxpayers and $150,000 for joint filers to receive the full payment, with payments reduced by $50 for every $1,000 of income above those limits.

Also, the payments phase out entirely for single taxpayers earning $95,000 and joint filers earning $170,000, implying that not all income earners will qualify for the payments.

Commenting on the fiscal measure, Jackson Hewitt’s chief tax information officer, Mark Steber, said the tax system “has become a machine for social change. The pandemic supersized that.”

The IRS has said that an estimated 36 million households are in line to receive the payments, which will be sent each month until the payments end in December this year.

In her remarks, vice president for family income support policy at the left-leaning Center on Budget and Policy Priorities, LaDonna Pavetti, said: “One thing the Child Tax Credit will do is create some stability to make sure there is a basic level of income for every child.

“That is really critical because one thing we know about families who are on SNAP or [the welfare program] TANF is that their situations are very volatile”, she added.