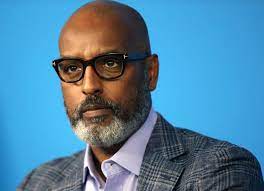

The President of the Association of Bureau De Change Operators of Nigeria (ABCON), Mallam Aminu Gwadabe, has described speculations about the Naira exchange rate against the dollar and other international currencies by some analysts this year as undesirable for the current efforts by the fiscal and monetary authorities to stabilize the national currency’s exchange rate and sustainable growth of the economy.

Apparently reacting to the latest projections by Pricewaterhouse Coopers (PwC) in its Economic Outlook for 2019 that the Naira depreciate to between N390 and N415 in exchange to a dollar this year, the industry operator felt that there was no basis for such speculative figures given the current economic realities in the country.

PwC hinged its projections on the unpredictable changes in the international oil market, with crude oil export being a major foreign exchange earner for the country.

Gwadabe said that the company’s projections were mere pundit juxtaposed analysis, unbelievable, speculative and an act of western sabotage even while admitting that the nation’s economy is dependent largely on proceeds of oil, which is subjected to the whims and caprices of the capitalist dictates.

According to him, despite the vagaries in the global oil markets recent economic reforms in the country and the results, when analysed from the increasing level of investors’ confidence, high inflows and the increasing Diaspora remittances into the economy, indicate that the economy will be able to absorb any shocks the oil price volatility would trigger.

He clarified: “The level of our diversification in terms of rice production, refineries, 42 items ban list, fiscal discipline and stronger macroeconomic policies of the CBN, will continue to provide cushion to any anticipated oil price volatility

“High tax revenue of the FIRS is cogent attributes for our navigation to an economic destination paradise”, Gwadabe added.

In its latest report, PwC forecasts that Nigeria’s forex market is expected to remain stable early this year, cautioning however that the volatility of the global oil market may cause depreciation of the Naira.

The company noted that the CBN increased dollar injections into the forex market last year by 87 percent or to the tune of $40 billion in its efforts to achieve Naira exchange rate stability.