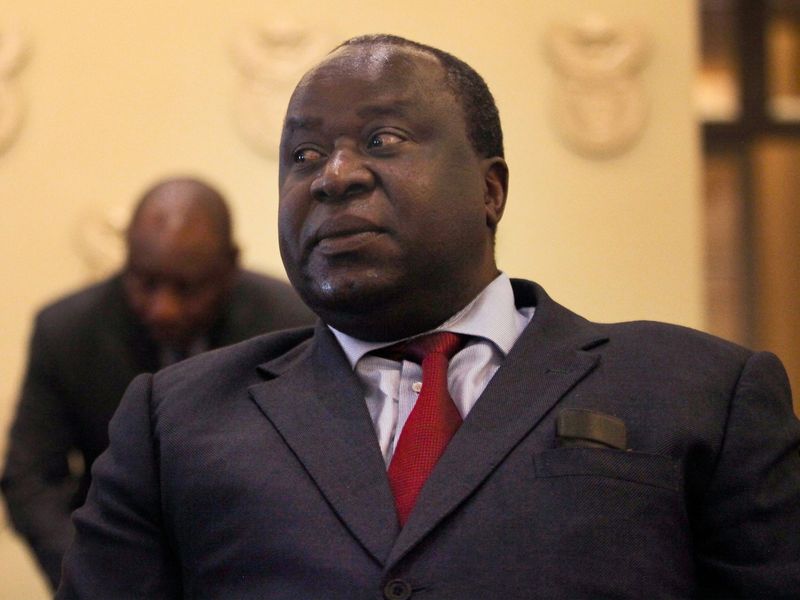

South African new Finance Minister, Tito Mboweni, will on Wednesday seek 50 billion rand ($3.5 billion) for a stimulus package as the country contends with fiscal challenges in 2018 budget implementation

Mboweni, the former central bank governor who took over the finance ministry barely two weeks ago after Nhlanhla Nene resigned, has to do that after an inflation-beating wage increase for civil servants and with state companies burning cash.

A news report by Bloomberg also indicated that the minister would have to explain how the government plans to stem escalating debt to help ward off another credit-rating downgrade, that its self-imposed spending ceiling remains intact, and that the first-half recession is a thing of the past.

According to a Bloomberg survey, there are indications that the government will not meet its goal of narrowing the budget deficit to 3.6 percent of Gross Domestic Product (GDP) in the current fiscal year.

Commenting on the government’s fiscal challenge, an economist at Capital Economics Ltd, John Ashbourne, said that “there’s really no doubt that this year’s budget will contain a lot of bad news — the only real question is how bad.

“Mboweni will prioritize holding to the deficit target, but this will require painful cuts. There isn’t, frankly, a lot of money available”, he predicted.

According to Bloomberg survey, economists see South Africa’s budget gap larger than February forecasts and advised that President Cyril Ramaphosa’s recovery plan demanded that spending be re-jigged to fund projects that can spur growth and cut into the country’s unemployment rate of 27 percent, near a 15-year high.

The latest fiscal and macroeconomic challenges are coming after South African economy slipped into its first recession in a decade and S&P Global Ratings and Fitch Ratings Ltd. cut the nation’s debt to junk last year.

Moody’s Investors Service, which still assesses South Africa at investment grade, warned this month it could follow suit if the government doesn’t stabilize debt.

Ramaphosa replaced Jacob Zuma as president in February, vowing to stimulate growth, attract investment, fix state companies and root out corruption. The budget comes a day before the start of a three-day investment summit to help lure $100 billion into the economy, with investors seeking evidence finances are under control.

The head of economics at Standard Bank Group Ltd, Africa’s biggest lender, Elna Moolman, predicted:“We expect some revenue under-performance, though the year-to-date data suggests that this should be modest.

“The challenges will rather be on the expenditure side, where the higher-than-budgeted wage settlement, spending related to the presidential stimulus and recovery plan, and possible support for the state-owned companies would have to be accommodated”, Moolman added.

Economists in a Bloomberg survey estimate the budget deficit at 3.8 percent of GDP in the current fiscal year, and that it will be in line with the Treasury forecasts of 3.6 percent and 3.5 percent for the next two.

Gross debt was projected by officials in February to peak at 56 percent of GDP in 2021. While the cost of servicing this is the third-fastest growing expense in the budget, the projection was an improvement on the more than 60 percent given a year ago.

Personnel costs account for about 35 percent of state spending, and a three-year wage agreement will see 1.3 million civil servants getting raises of as much as 7 percent for the year through March 2019.