The World Bank has reported that the external debt stock of developing countries, comprising low and middle-income economies, accumulated to $9 trillion at the end of 2021 with about 60% of the poorest countries already at high risk of debt distress or already in distress.

The bank noted that the debt stock grew more than double the amount owed by the various countries a decade ago.

The Breton Woods multilateral institution in its just published ‘International Debt Report’ disclosed that the poorest countries eligible to borrow from the World Bank’s International Development Association (IDA) now spend over a tenth of their export revenues to service their long-term public and publicly guaranteed external debt, representing the highest proportion since 2000 shortly after the Heavily Indebted Poor Countries (HIPC) initiative was established.

The report, which also highlighted rising debt-related risks for all developing economies, indicated that

during the same period, the total external debt of IDA countries nearly tripled to $1 trillion, as rising interest rates and slowing global growth risk continue to push many countries into debt crises.

According to the bank, at the end of 2021, IDA-eligible countries’ debt-service payments on long-term public and publicly guaranteed external debt totaled $46.2 billion, which is equivalent to 10.3% of their exports of goods and services and 1.8% of their gross national income (GNI).

The Washington D.C-based multilateral institution projected that in 2022, IDA countries’ debt-service payments on their public and publicly guaranteed debt could rise by 35 percent to more than $62 billion, one of the highest annual increases over the past two decades.

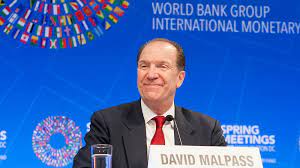

Commenting on the report’s findings, the World Bank Group President, David Malpass, said: “China is expected to account for 66% of the debt-service payments to be made by IDA countries on their official bilateral debt. The debt crisis facing developing countries has intensified.

“A comprehensive approach is needed to reduce debt, increase transparency, and facilitate swifter restructuring—so countries can focus on spending that supports growth and reduces poverty. Without it, many countries and their governments face a fiscal crisis and political instability, with millions of people falling into poverty”, Malpass added.

The report showed that on the surface, debt indicators seemed to have improved in 2021 as economic growth resumed following the global recession in 2020, public and publicly guaranteed external debt as a share of GNI returned to pre-pandemic proportions.

It further indicated that, however, this was not the case for IDA countries, where the debt- to-GNI ratio remained above the pre-pandemic level at 25%. Moreover, the economic outlook has considerably deteriorated.