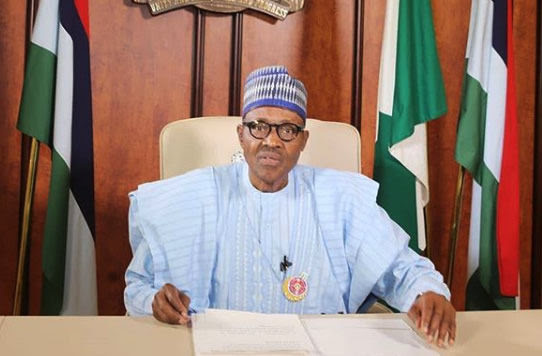

President Muhammadu Buhari on Thursday directed ministries, departments, agencies (MDAs) and businesses to grant access to the Federal Inland Revenue Service (FIRS) to their systems for the purposes of tax collection nationwide.

President Buhari issued the mandate on Thursday while delivering his address as the Special Guest of Honour at the First Annual National Tax Dialogue organized by the FIRS at Aso Rock Villa, Abuja.

A statement by FIRS Director of Communications and Liaison, Abdullahi Ismaila Ahmad, quoted President Buhari as directing FIRS to speedily put all measures in place to fully implement programmes to stamp out Base Erosion and Profit Shifting in all of its ramifications and generally automate its tax processes.

The President expatiated: “I have directed all government agencies and business enterprises to grant FIRS access to their systems for seamless connection. We all are now living in a fast digitalising world. As such, business transactions are continually being migrated from “brick and mortar” locations to digital places or spaces.

“It is therefore incumbent upon tax authorities to adopt digital means to efficiently track taxable transactions for the purpose of collecting taxes. In order to provide the necessary legislative framework for the adoption of technology in tax administration, we also made necessary amendments to the FIRS Establishment Act in the Finance Act 2020.”

Earlier in his welcome address, the Service Executive Chairman, Mr. Muhammad Nami, said the agency was working towards “developing a robust digitalisation roadmap”, adding that the cooperation of the three tiers of government, the citizens and corporate organisations remains key for the success of the digitalization drive.

He said: “The FIRS started the journey to automation several years ago when it launched “Project Fact”. Several other initiatives were launched to further take advantage of evolving technology in taxpayer registration, online payment platforms, remote filing of returns, etc. However, there was very limited success with the various initiatives due to inadequate statutory framework.

“A quantum leap was achieved with the 2020 Finance Act which copiously provided legal grounds for deployment of technology in tax administration. The Service is grateful to the President, the leadership of the National Assembly, the Honourable Minister of Finance, Budget and National Planning and all other stakeholders that worked together to enact the necessary laws.

“The Service is taking advantage of the new law to embark on studies (with the assistance of friendly tax authorities and international tax organisations) with a view to developing a robust digitalisation roadmap. The roadmap will enable the Service to digitalise its whole operations (end-to-end) in a systematic, coherent and efficient manner.

“There is so much to look forward to in the coming years. The FIRS is starting this decade with the resolve to leapfrog tax administration into the digital age. Ladies and gentlemen, we are banking on your continued support as we embark on this onerous journey”, Nami added.

The theme of the dialogue was “Taxation in a post-Covid Economy”