As the deadline for the submission of implementation plans on their recapitalization ends today, most deposit money banks (DMBs) are revving up their efforts to ensure full compliance with the regulatory deadline, BRTNews has reliably gathered.

The Central Bank of Nigeria (CBN) had, last month, raised the capital requirement of banks in the country, giving them a two year period to meet the new capital base or explore other options such as mergers/acquisitions or downgrade of banking license.

According to the new requirement, commercial banks with international licenses are required to have a capital base of N500 billion while their national and regional counterparts are required to have capital base of N200 billion and N50 billion respectively.

Similarly, the capital base of national non-interest banks were raised to N20 billion while that of regional non-interest was raised to N10 billion. Merchant banks capital base was also raised to N50 billion.

Investigations by our correspondent on the lenders’ efforts to beat the deadline showed that most of the banks were favourably disposed to ‘rights issue’ so as to maintain the current ownership structure.

Indications of the banks’ preference for the option are reflected in the current arrangement are changing their ownership strategy in which majority shareholders/owners serve as chairmen of the Holden Companies, particularly among the tier one lenders.

For instance, Access Holdings Plc, the parent company of Access Bank, was the first lender to secure its shareholders’ endorsement to raise additional capital at the end of its second Annual General Meeting (AGM) in Lagos at the weekend.

Specifically, the shareholders of the financial conglomerate had approved the N365 billion rights issue out of the $1.5 billion for capital raising alongside the N1.80 kobo dividend payment, which translated to a total of N2.80 paid up share capital for 2023.

Also, Zenith Bank held its EGM last week where shareholders approved the Holding Company structure.

However, although FBN Holdings, the parent company of First Bank of Nigeria (FBN) had scheduled an EGM for the end of this month to raise additional N300 billion to shore up its capital base, the EGM was unexpectedly cancelled, ostensibly due to the sudden resignation of the managing director.

Despite their current drives to comply with the minimum capital base requirements, experts have forecasted that with most of the DMBs facing serious capital adequacy shortfalls, not more than five of the leading banks in the country may be able to raise the N500 billion capital.

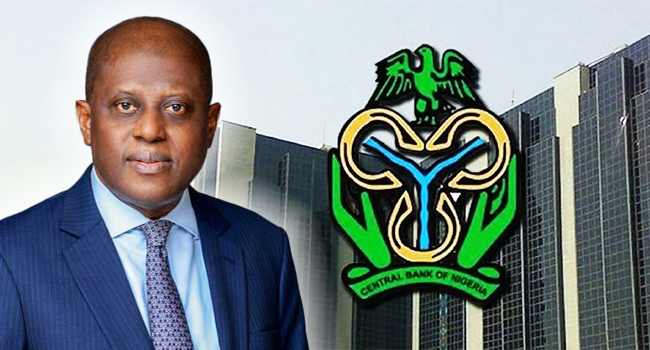

About two weeks ago, the apex bank governor, Olayemi Cardoso, had at the 2024 Spring Meetings of the International Monetary Fund (IMF)/ World Bank explained that the DMBs have sundry options to shore up their capital bases to meet the regulatory requirements

Cardoso, who expressed this view during the ‘Governor Talks’ said he had, at the Bankers’ Dinner held last year, communicated the intentions of the apex bank concerning the plan to raise capital base in the banking industry to stakeholders in the banking system.

He said: “I used that opportunity to communicate very strongly on forward guidance with respect to the banking sector, and to let people know that we were going to have a recapitalisation exercise. This was in November and the guidelines didn’t come out till just recently. So, we had plenty of time to start thinking that through.”

Analysts project that to meet up with the new capital base requirements, the banks need to attract over N3 trillion investments through mergers and acquisitions and reclassification, which means either an upgrade or downgrade of banking licence.