….. as investors eye BoE, ECB meetings

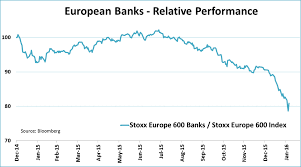

Weakness in bank stocks dragged European shares to a downbeat open today as financial sectors caught the cold from U.S. and Asian trading which suffered from a less hawkish than expected tone from the U.S. Federal Reserve.

The German share price index, DAX board, is seen at the stock exchange in Frankfurt, Germany, December 13, 2017.

A news report sourced from Reuters stated that despite the Fed’s rate rise which is a boost to lenders, banks were the worst-performing sector in Europe as cautious comments from Chair Janet Yellen on persistently low inflation shook investors’ confidence in financial stocks.

Specifically, the report showed that these fiscal trends dragged Europe’s STOXX 600 down 0.2 percent, while euro zone blue chips .STOXX50E fell 0.1 percent. Italy’s FTSE MIB .FTMIB rose 0.3 percent following heavy losses in the previous session due to resurfacing political worries.

Banks HSBC (HSBA.L), Santander (SAN.MC), Credit Suisse (CSGN.S) and UBS (UBSG.S) were the biggest drags to the STOXX.

Reuters reported further on the stock market trend that attention turned to Europe’s central bank meetings later on Thursday with the Bank of England and European Central Bank both expected to keep rates on hold.

“Steinhoff (SNHG.DE) shares sank 12.5 percent after the latest twist in the South African retailer’s accounting woes, when it said it would have to restate 2016 financial results. Dassault Aviation (AVMD.PA) shares fell 2.4 percent after the firm said it plans to axe and relaunch its Falcon 5X jet after engine delays.

“Among gainers, wind turbine maker Vestas Wind (VWS.CO) rose 4.9 percent, with its Spanish peer Siemens Gamesa SGEN.MC also up 1 percent. In merger news, UK-listed platinum producer Lonmin’s (LMI.L) shares soared 16.5 percent after South Africa’s Sibanye-Stillwater offered to buy it in a deal valued at 285 million pounds. ”, the news report added.

Meanwhile Atos (ATOS.PA) fell back, down 2.8 percent, after Gemalto (GTO.AS) rebuffed the French technology consultancy’s takeover offer.