The Government of Bermuda has announced the country’s readiness to join the Organisation for Economic Co-operation and Development’s (OECD’s) ‘Inclusive Framework’ for international taxation in demonstration of its commitments to transparency, cooperation and high levels of compliance with international standards.

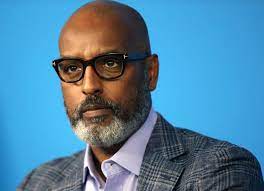

The country’s Minister of Finance, Curtis Dickinson, had earlier responded to the global minimum corporate tax rate that was discussed by G7 leaders, highlighting the importance of cross-border trade to the Bermuda economy.

According to a news report by Reinsurance News, an online medium, Bermuda’s leaders said they “recognised the need to join with other members of the Inclusive Framework to reach this position supported by a significant majority of the membership.

The Minister expatiated: “We fully intend to remain an active participant in the ongoing work of the Inclusive Framework to complete the development of an appropriate plan. We have noted areas of concern at a technical and practical level, which we look forward to working to resolve constructively in the months ahead.

“Financial services remain a crucial area of focus for us, and the private sector, given our role as a global hub in key industries such as insurance/reinsurance. Businesses in this sector aid many of the world’s most vulnerable in adversity, and provide climate risk insurance which will be at the heart of making our planet sustainable.

“In relation to the former, Bermuda re/insurers have paid out more than a quarter of a trillion dollars over the past twenty years in claims arising from both natural and manmade disasters in the US and EU alone. We remain committed to working collaboratively with partners in the public and private sector to maximise benefits which can be achieved as a result of this initiative”, Dickinson added.

A recent poll by Reinsurance News found that 57% of industry participants felt the introduction of a global minimum corporate tax rate would negatively impact the insurance and reinsurance landscape.

With much of the world’s re/insurance activity channelled through offshore financial centres, it is thought that such a concept could be seismic in its effect for hubs such as Bermuda and the Cayman Islands, which has also responded to the recent tax plans.