United States’ (U.S’) Consumer Price Index (Inflation) rose less than expected in August, as increases in gasoline and rents were offset by declines in healthcare and apparel costs, and underlying inflation pressures also appeared to be slowing., Reuters has reported.

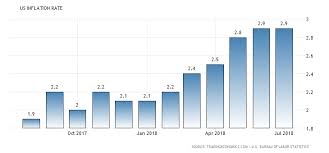

Specifically, the CPI increased 0.2 percent last month after a similar gain in July. In the 12 months through August, the CPI increased 2.7 percent, slowing from July’s 2.9 percent advance.

With the volatile food and energy components excluded, the CPI edged up 0.1 percent.

The statistics on the CPI trend trend showed that in the 12 months through August, the core CPI increased 2.2 percent after rising 2.4 percent in July.

The inflation report will probably do little to change expectations that the Federal Reserve will raise interest rates at its Sept. 25-26 policy meeting. The U.S. central bank has raised rates twice this year.

The Fed tracks a different inflation measure, the personal consumption expenditures (PCE) price index excluding food and energy, for monetary policy. The core PCE price index increased 2.0 percent in July, hitting the Fed’s 2 percent target for the third time this year

According to the news report, despite the moderate consumer price increases last month, inflation pressures are steadily building up, driven by a tightening labor market and robust economic growth.

Specifically, the labor market strength was reported to have been reinforced by other data today, indicating that the number of Americans filing for unemployment benefits dropped last week to near a 49-year low.

Commenting on the inflation and labour market trends, the Chief U.S. Economist at Capital Economics in Toronto, Paul Ashworth, said that “there is no reason to suspect that the weaker increase in consumer prices in August is the start of another dip like we saw in early 2017.

“With labor market conditions tight, wage growth accelerating and input prices being pushed up by capacity constraints and recently imposed tariffs, there is plenty of upward pressure on prices”, Ashworth added.

Analysts forecast that an escalating trade war between the United States and China is expected to drive up inflation.

President Donald Trump had last week threatened duties on another $267 billion worth of Chinese goods on top of a $200 billion tariff list that is awaiting his decision.

Before then, Washington had already imposed duties on $50 billion worth of Chinese imports, provoking retaliation from Beijing.