The Chartered Institute of Bankers Nigeria (CIBN) has explained the roles of data analytics deployment in current efforts to optimize the financial industry’s performance, particularly in service efficiency value addition for profitability and national economic growth.

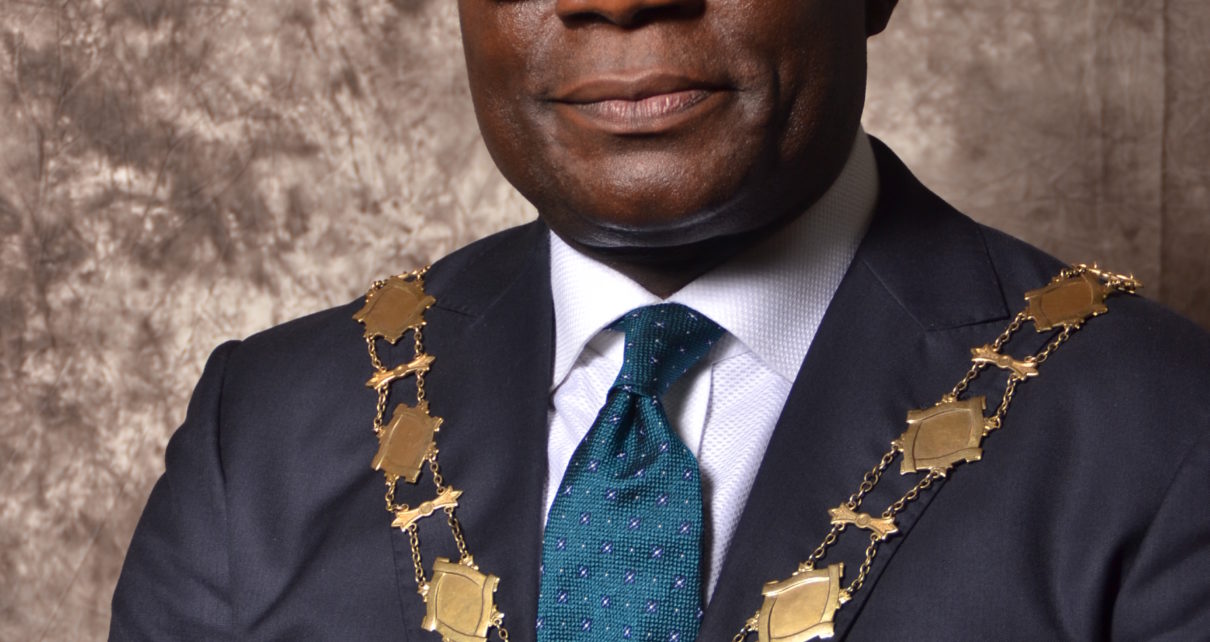

The President of the professional body, Dr. Uche Olowu, gave the explanation during a breakfast session on theme ‘Predictive Analytics for the Nigerian Financial Sector: Exploring New Frontiers for Value Creation, organised by the Institute in collaboration with the Centre for Financial Studies in Lagos.

The seasoned banker noted that collaboration between Financial Technologies (FinTechs) and the banks was desirable to ensure that banks leverage the ongoing digital revolution to render improved services to their customers.

He explained: “We shall ensure that banks leverage on data analytics to render more efficient services but the banks cannot do that alone because at the base are the Fintechs disrupting the retail space.

“The best banks could do now is to create that strategic alliance between the Fintechs and the banks because the ways and manners that banking services are delivered are changing its forms especially in the retail space.

“The channels and the models are changing so there is the need for the banks to leverage on technology to renew their service agreement with the customers in creating value. With data analytics, the banking sector would be more efficient, and would be closer to their customers”, Olowu added.

The CIBN leader pointed out that data analytics would enable the banks have reliable customer information and tap into the available data at their disposal to boost their operational efficiency and by so doing, grow investors’ funds and their profitability.

Speaking at the forum, a technology expert, Olumide Soyombo, identified one of the challenges facing the banking sector as inability to make use of the available data efficiently which should be addressed.

He said: “The problem the banks have today is that; the data is there but they are not using it efficiently. I am speaking about actionable data steps in the financial services space and how it can be used. The Business Intelligence (BI) system and data warehouses that the banks have today tell them what they already know but its judicious use is the problem.

“The Telecommunication operators (Telcos) have become very good at creating actions from the data that they have. If you have noticed, if you spend up to a certain amount on a certain day, the Telcos can offer you a bundle and do the fulfilment right away.

“The banks do not have those channels for fulfilment, so creating actionable data sets and the desired fulfilment has been a challenge,” he said.

The industry expert pointed out that the solution to creating actionable data sets depended on the bank’s building up analytical models that take data from their traditional data warehouses and BI solutions, and harness the opportunities from the inside.

Oluyombo, who is also the Co-Founder, Bluechip Technologies Limited, stressed that despite some of their constraints, a lot of opportunities existed that the banks are missing due to their inability to optmise the advantages in their data, adding that there are many touch points with customers even within the banks which they are not taking advantages of.

According to him, harnessing actionable data will help the banks to retain customers and position them for improved profits.

The IT solutions expert pointed out further that combining in-house data with external opportunities would help the banks to identify and seal new business deals.