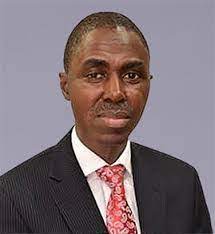

A leading tax expert, Mr. Taiwo Oyedele, has rated Nigeria’s company income tax rates as one of the highest globally and described the fiscal regime as a major disincentive to business growth in the country.

Oyedele, who is also the Tax leader, PwC Nigeria, made the remarks at the weekend during the Finance Correspondents Association of Nigeria’s (FICAN’s) 2019 annual workshop with the theme “Unlocking Opportunities in Nigeria’s Non-Oil Sector” held in Lagos.

Specifically, the tax professional disclosed that currently Nigeria’s CIT rate remained among the top 10 in the world.

He explained: “We pay Company Income Tax, CIT 30%, education tax, 2%, whatever is left, we pay withholding tax of 10%. If you add it together, it is more that 40% already. If you now make a mistake of having a group and you say it’s a holding company, another 30%. Who does that?

“When you start a business today, there is something called commencement rule. It is supposed to punish you during commencement, so that you pay tax twice. It does not make sense.”

“What I keep saying to government is that I can insist that I have a pot that is this small and I say I must get 60% of this pot by all means. Or I allow this pot to be big enough and then get 10% of it. Government must remove tax disincentives.

“One thing I am asking the business community is stop asking the government for incentives because they will think they are doing you a favour. Ask them to remove the disincentives that are not allowing us to do business”, Oyedele added

To make the existing fiscal system more investment-friendly, the tax expert advised business owners to keep demanding for removal of some of these disincentives that are hampering their global market competitiveness, profitability and sustainable growth.

This is even as he charged the fiscal authorities to review their thinking about taxation as what they are doing now has only made compliance difficult.

He expatiated: “Our thinking around taxation is completely upside down as a country. Nigeria does not seem to understand that you need to be prosperous so that you can pay tax. So, tax does not just fall from heaven.”

“As a government, I should help you make money so that you can pay me tax. It’s just common sense. Nigeria has a tax system that does not allow businesses to thrive, whether you are small or big.

“The reason Nigeria cannot make money from tax, and is not a curse, is that it continues to beat up the people at the bottom of the ladder. But they cannot give you what they don’t have. In societies where they think things logically, they focus on the top 1% who are the rich and big companies and they will get the desired tax result”, Oyedele stressed.