The Manufacturers Association of Nigeria (MAN) on Wednesday advised the Federal Government to harmonize taxes/levies/fees payable by businesses in the country in order to attract more investments for sustainable development of the country.

The group also believed the step would translate to higher productivity and more tax revenue for the government in the medium and long terms.

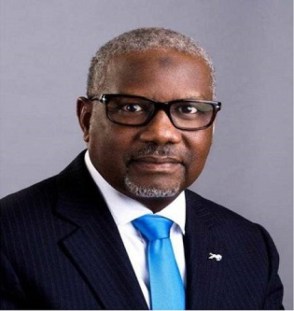

Expressing the manufacturers’ views on the fiscal regime generally, its Director General, Mr. Segun Ajayi-Kadir, in a statement which had to do with the proposed VAT rate hike pointed out that Nigeria’s tax rates should ideally be compared with the emerging economies and not just any country in Africa.

According to him, comparative economic policies should be predicated on what obtains in this economic frontier, adding that in terms of misery index rating, low per capita income, heavily lopsided income distribution pattern, the Nigerian economy will be in a more vulnerable state if VAT is increased.

He explained: “No controversy, the burden of the tax would be shifted to the Nigerian consumers that are already struggling, the economy would certainly experience demand crunch, inventory of unsold items would soar, profitability of manufacturing concerns would be negatively impacted, many factories will witness serious downturn or wind down operations.”

Ajayi-Kadir warned that the proposed upward review of VAT rate would also worsen the already high unemployment position of the country now hovering over 23 percent if more companies run into operational crisis as a result of new taxes.

He pointed out that “an ideal tax policy should be such that takes into cognizance the status of the economy. An ideal VAT policy for Nigeria should take into account the current profiles of Nigeria’s Per Capita Income (PCI), National Minimum Wage (NMW); and Global Competitiveness.

“PCI and NMW will help highlight what will be the implication of upward review of VAT on the already depleted wellbeing of majority of Nigerians, while Global Competitiveness will present insight on the impact of such review on the real sector, particularly manufacturing sector.

“MAN hereby implore Government not to increase the VAT at this point in time but consider the implementation of the afore-mentioned tax specific recommendations and continue to ramp-up support for the manufacturing sector in the best interest of the over 200 million Nigeria”, the DG added.