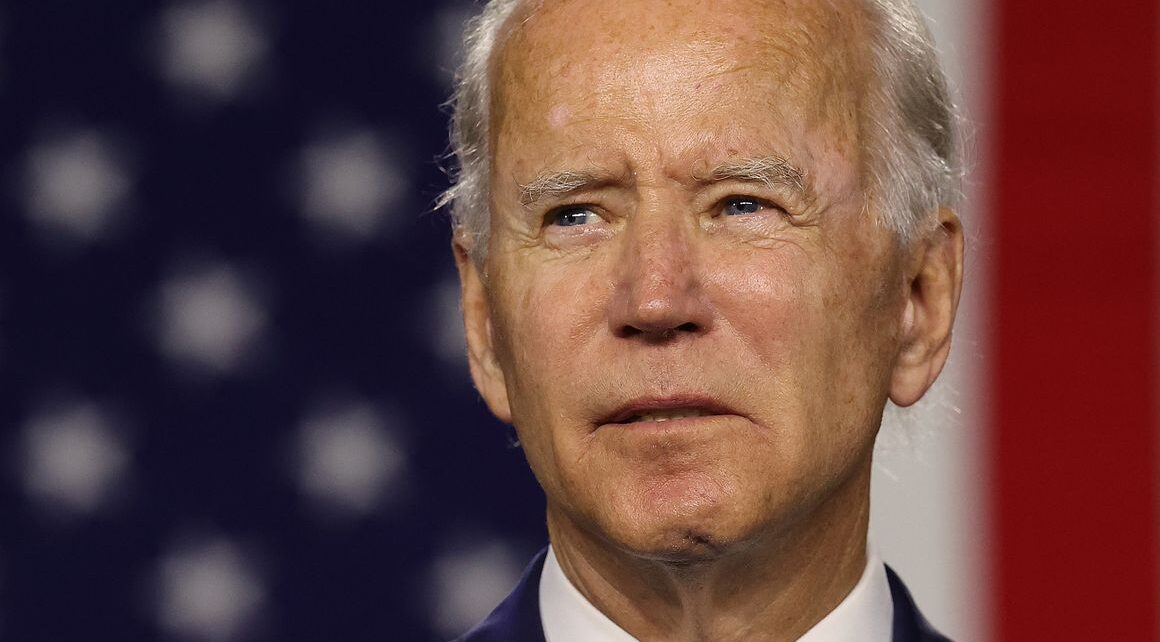

President Joe Biden appears to be facing an uphill task in his administration’s efforts to hike tax as part of its fiscal drives to fund multitrillion-dollar infrastructure investments he promised to build in the coming months.

The stand-off between the White House and corporate entities is rising as President strikes nearer to clinching congressional approval for an instantaneous $1.9tn fiscal stimulus plan by mid-March.

The Biden administration and enterprise teams had largely agree on the necessity for added large-scale authorities funding to modernise US infrastructure, finance analysis and growth and promote inexperienced power.

But then, probably the most influential foyer teams representing company America in Washington are opposed to hiking their taxes to pay for the measures.

According to news reports, the enterprise owners argued that together with the tax hikes in a invoice later this 12 months could be economically dangerous and will torpedo the laws.

Commenting, the chief coverage officer on the US Chamber of Commerce, Neil Bradley, was quoted by Financial Times as saying: “I can simply say that from the business community’s perspective, raising the corporate tax rate is going to make American companies less competitive at the very moment that we need a broad economic recovery.

“And it’s going to make passing a bill probably next to impossible”, Bradly added.

The Business Roundtable, whose members encompass the biggest blue-chip corporations, can be opposed to a rise in company taxes to fund infrastructure spending.

For everlasting insurance policies that incur ongoing prices, the president is dedicated to paying for them by asking the wealthiest Americans and companies to pay their fair proportion

It would be recalled that during the 2020 marketing campaign, Biden referred to as for a rise within the US company revenue tax from 21 per cent to 28 per cent, partially reversing the tax cuts enacted by his predecessor in 2017, as each a matter of budgetary prudence and a matter of fiscal fairness.

The White House has not laid out any particulars of its subsequent financial proposal centred round infrastructure, transport, and clear power.

However, inner discussions are beneath approach and the president has met publicly with enterprise and commerce union leaders as he develops the plan.

Analysts expect the administration’s proposals to price between $2tn and $4tn relying on the specifics. The White House has not confirmed any price ticket.

The longer-term spending would come on prime of the non permanent stimulus bundle already in prepare.

Already, the House of Representatives is about to transfer ahead this week with a invoice containing $1.9tn of pandemic aid, together with for people and state and native authorities.

A White House spokesperson was quoted by FT as saying that “the president has long talked about how critical it is that — when we turn to plans for our economic recovery – we invest in America, create millions of additional good-paying jobs, combat the climate crisis, advance racial equity, and build back better than before.

“For permanent policies that incur ongoing costs, the president is committed to paying for them by asking the wealthiest Americans and corporations to pay their fair share,” the spokesperson added.

In addition to increased corporate taxes, Biden has proposed growing capital features taxes on people incomes greater than $1m and better payroll taxes for top revenue households.