The representatives of the Organisation for Economic Co-operation and Development (OECD) and the Federal Inland Revenue Service (FIRS), have re-opened discussions on how the OECD-initiated Two-Pillar Tax Solution (Global Minimum Tax Rules) could be implemented without causing loss to Nigeria. The discussions formed part of the key agenda of the two-day workshop held on 4th […]

Tag: Organisation for Economic Co-operation and Development (OECD)

UK Chancellor Backtracks On Dividend Tax Cut Measures

The new British Chancellor, Jeremy Hunt, has scrapped his predecessor’s plans to reduce the tax paid on dividends. In his mini-budget at the end of September, Kwasi Kwarteng announced that he would be rolling back Rishi Sunak’s plans to increase the basic rate of tax paid on dividends from 7.5% to 8.75%. A news report […]

FIRS Tasks African Govts On Taxation Of Digital Businesses

The Federal Inland Revenue Service (FIRS) has reiterated the need for improved collaboration among countries and international stakeholders for the purposes of exploring alternative rules that will enable market jurisdictions, particularly African countries, to effectively subject digital businesses to tax. The Executive Chairman of the FIRS, Mr. Muhammad Nami, made this remark last weekend at […]

Togolese, Houngbo, Elected New ILO Director General

The International Labour Organization’s (ILO) has announced a Togolese, Gilbert Houngbo, the current President of the International Fund for Agricultural Development (IFAD), as its next Director-General. Houngbo was elected by the ILO’s Governing Body, comprising representatives of governments, workers and employers, during their meeting in Geneva. He will be the 11th Director-General of the ILO, […]

Why Nigeria Didn’t Sign OECD Minimum Corporate Tax Pact – FIRS

The Federal Inland Revenue Service (FIRS) has explained why Nigeria did not sign the Organisation for Economic Cooperation and Development (OECD) G20 Inclusive Framework two-pillar solution to tax challenges of the digitalized economy. The OECD G20 Inclusive Framework two-pillar solution proposes a framework of rules aimed at tackling base erosion and profit shifting, and providing for […]

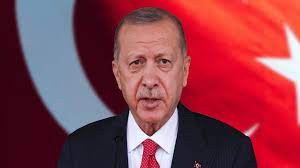

Turkey Overtakes UK, Now Second-Fastest Growing Economy In OECD

A new report by the Organization for Economic Cooperation and Development (OECD) has placed Turkey ahead of the United Kingdom as the second-fastest growing economy in the third quarter of 2021. In the report published on Tuesday, Chile topped the OECD-countries’ growth chart, with the economy recording the highest gross domestic product (GDP) growth rate […]

Global Minimum Tax May Reduce Bermuda’s Competitive Edge – Fitch

Fitch Ratings has predicted that the net profitability gap between Bermuda and non-Bermuda incorporated companies may narrow over time given the expected passage of the OECD-driven multilateral agreement to establish a 15% global minimum tax rate. The 15% global minimum tax rate is expected to be ratified under Pillar Two of the OECD Inclusive Framework […]

ActionAid Supports FG’s Non-Endorsement Of OECD Tax Deal

ActionAid Nigeria (AAN) at the weekend expressed its support for the Nigerian government’s reluctance to sign the Organisation for Economic Co-operation and Development (OECD) tax deal in view of its lopsided provisions that it observed were not in favour of developing economies. The Country Director of the civil society organisation, Ene Obi, in a statement […]

Bermuda Joins OECD’s Global Taxation Plan

The Government of Bermuda has announced the country’s readiness to join the Organisation for Economic Co-operation and Development’s (OECD’s) ‘Inclusive Framework’ for international taxation in demonstration of its commitments to transparency, cooperation and high levels of compliance with international standards. The country’s Minister of Finance, Curtis Dickinson, had earlier responded to the global minimum corporate […]

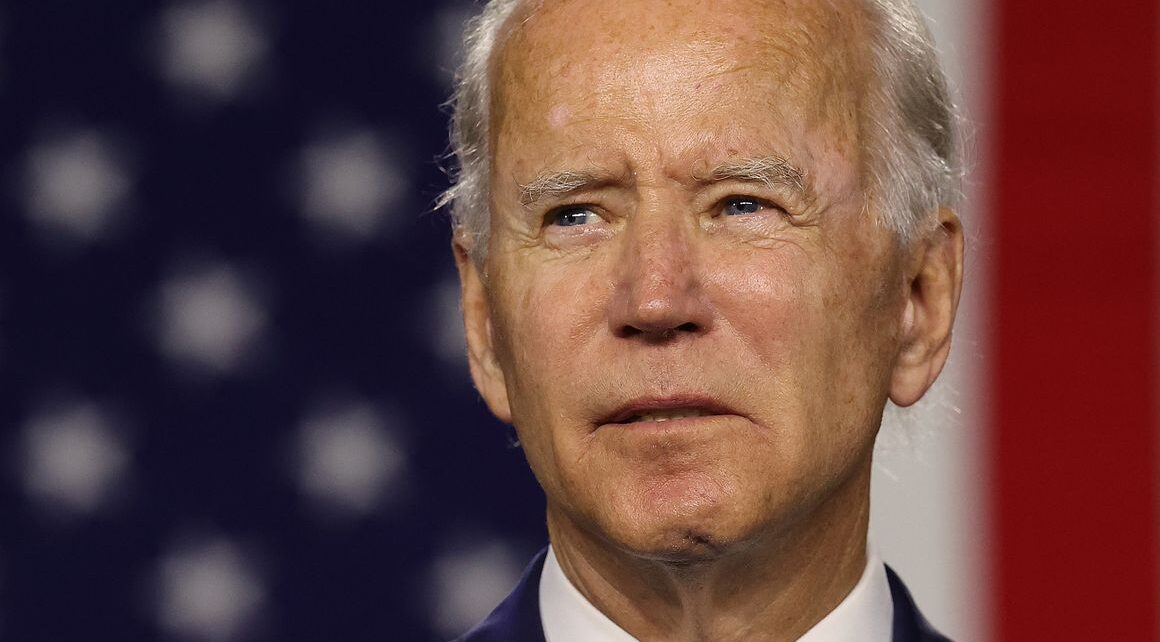

Global Minimum Corporate Tax Rate Proposal Gains Traction

President Joe Biden’s campaign promise to crack down on tax-evading multinationals and recent call for a global minimum corporate tax rate has continued to elicit reactions from major players in the global economic space as some fear that President Biden’s plan may hinder developing economies’ Covid-19 recovery. The President had in April, as part of […]