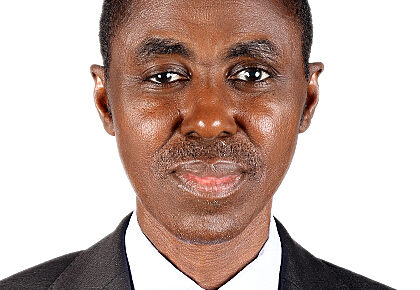

The Secretary to the Government of the Federation (SGF), Boss Mustapha, has made a case for amendment of the Establishment Acts of Federal Government Owned Enterprises (FGOES) to reflect the current economic realities in the country.

Mustapha made the call for the legislative action in his keynote address delivered at a Retreat for Chief Executives and Treasury Directors of Revenue of the Federal Government Owned Enterprises (FGOES), held in Abuja.

He said such amendment should also reflect government’s current policy thrust in optimizing revenues accruing from the FGOEs through remittances of operational surpluses.

This is even as he also stressed the need for the “amendment of the establishment Acts of some FGOEs to reflect current economic realities and policy thrust of the government in optimizing the revenues accruing from FGOEs through remittances of operational surpluses.”

The SGF, who was represented at the forum by the Permanent Secretary, General Services office (OSGF), Dr. Maurice Mbaeri, noted that there was the need “for strong corporate governance reform, expenditure controls and strengthening the budgetary and financial reporting requirements of the FGOEs.”

In her address, the Minister of Finance, Budget and National Planning, Dr. (Mrs.) Zainab Ahmed, maintained that domestic revenue mobilization remained strategically pivotal to sustainably finance Nigeria’s development needs.

The Minister, who in 2020 approved the deployment of Treasury Revenue Directors to 10 FGOEs, advised the Treasury Directors of Revenue and the FGOEs to work together to achieve the desired objectives.

In his remarks, the Accountant General of the Federation, Ahmed Idris, said the deployment of Treasury Directors of Revenue to FGOEs impacted positively on IGR which rose from N532.90 billion in 2020 to N1.250 trillion in 2021.

He expressed optimism that there would be improvement in government’s revenue inflows if the policy is sustained.