The Acting Chairman of the Revenue Mobilisation Allocation and Fiscal Commission (RMAFC), Mr. Umar Gana, has disclosed that its various investigations of tax remittances by banks, stamp duty collections, Withholding Taxes (WHT) and Value Added Tax (VAT) have led to the recovery of N268 billion from the affected institutions nationwide.

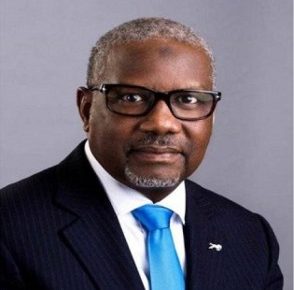

Gana, who made this disclosure through a statement issued the commission’s Head of Public Relations, Mr Ibrahim Mohammed, debunked media report that the absence of 30 commissioners in the commission had paralysed its activities.

He pointed out that the Act establishing the commission specified that five commissioners could form a quorum and take decisions as they affect its operations.

Gana stated that while most of the commissioners had vacated their seats following the expiration of their tenures in 2015, the commission has sustained its activities, including the three probes instituted which led to the recovery of N268 billion within the period.

For instance, he explained that the commission had successfully carried out verification and reconciliation of revenue collections by banks through which recoveries totalling over N73 billion were made.

Expatiating further, the RMAFC boss indicated that similar exercises on stamp duty collections and tax liabilities of the three tiers of government on WHT and VAT led to the recovery of N27 billion and N168 billion respectively.

Gana, who stressed that the few members remaining on board had continued to discharge their responsibilities without let or hindrance, however, pointed out that it was desirable to have all the commissioners appointed so that the commission could benefit from their wealth of experience and contributions to key decisions.

According to him, the RMAFC as a member of the Federation Account Allocation Committee and chair of the Post Mortem Sub Committee, has been supervising the disbursement of the statutory monthly allocations as required, including preparing attribution and indices for the 13 percent derivation to oil-producing states.

This is even as he recalled that in 2016, the commission conducted a nationwide monitoring exercise on revenue leakages in the solid minerals sector during which potential revenue of 10 out of 50 commercially-viable mineral types of up to N5 trillion were established.