Members of the Institute of Chartered Accountants of Nigeria (ICAN) have advocated the need for the Federal Inland Revenue Service (FIRS) to begin to sanction all the Federal Government Ministries, Departments and Agencies (MDAs) that failed to remit tax collections as a means of deterring others.

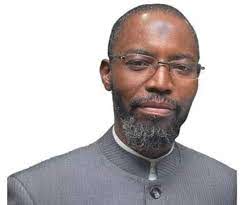

The President of the Institute, Razak Jaiyeola, expressed this position of the professionals while briefing the media on Thursday in Lagos at the conclusions and recommendations by members at the end of conference.

Jaiyeola, said that participants at the conference with the theme ‘Securing our shared future: A collective responsibility’ advised tax administrators to collaborate more with taxpayers to enlighten them on various aspects of the nation’s tax regime in order to improve voluntary tax compliance.

This is even as he expressed the position of the professionals on the issue of multiplicity of taxes which, they agreed, should be tackled expeditiously in the long term interest of businesses, governments and the national economy.

He explained: “Although the participants agreed that the tax payers, tax administrators and tax consultants should collaborate to achieve the goal of driving development through tax revenue, the participants noted that there cannot be tax justice when those with governance responsibilities do not pay and remit their taxes as and when due to the FIRS.”

Jaiyeola hinted further that the participants, who lauded FIRS’ adoption of technology in tax administration, advised the Service to appraise the outcome and impact of its various initiatives on tax compliance with a view to rating its actual performance and identifying where more efforts should be committed.

He pointed out further that one of the areas participants agreed should be focused on by the FIRS was on the issue of complaints about the down time often experienced by users of the various IT platforms and the slow process of seeking justice for incorrect tax assessment.

Other recommendations of the participants at the end of the yearly forum include, the need for FIRS to leverage Block chain and Bitcoin technology to enhance tax collection; amendments of the obsolete provisions of the tax laws, including the Stamp Duty Act of 1939, in the country.

The professionals advised the FIRS to reviews the huge withholding tax credits which, they noted, taxpayers were finding difficult to access to settle their tax liabilities.

They expressed optimism that these moves would go a long way in making the nation’s tax system more taxpayer-friendly and help in improving the Ease of Doing Business ranking of the country.