As current efforts of the Federal Government to fix the nation’s decaying infrastructure continued to gain traction, an expert has projected that funding the capital projects will require additional borrowing by the fiscal authorities.

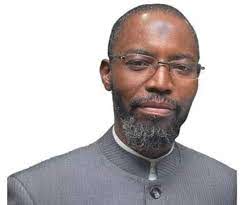

A Senior Analyst at Agusto & Co, Mr Jimi Ogbobine, made this prediction at the weekend during a training for financial journalists organized by the Finance Correspondents Association of Nigeria in Lagos.

According to him, although the Federal Government had budgeted about N1.6 trillion to fund capital projects this year, he submitted that in view of the growing demands for funding in other sectors of the economy, government would have to finance substantial part of its capital budget through borrowing.

Ogbobine pointed out that funding the capital budget through additional borrowing higher than earlier projected in the budget would come with attendant adverse implications for interest rates and other costs to the economy.

He explained: “The Federal Government’s borrowing to fund infrastructure is likely to be between N1.2tn and N1.6tn. The implementation is unlikely to start before the second quarter and revenue is likely to be lower than planned.

“Actual funding from asset restructuring, recoveries and others may be substantially lower than the planned level of N2tn. Therefore, fully funding the capital budget will mean higher than planned borrowing with adverse implications for interest rates and interest costs.

“Every kobo of infrastructure spending is financed by debt, which constraints the ability to fully fund budgeted amounts. Debt as a percentage of revenue is significantly higher than the median of 200 per cent for countries in Middle East & Africa. The Federal Government plans to partly finance the 2018 capital expenditure with proceeds of asset sales”, Ogbobine added.

Reflecting generally on the nation’s economic prospects this year, he predicted that the nation’s real Gross Domestic Product per capita should grow this year, making it easier for businesses to access forex to fund their operations.

As expected, Ogbobine forecasts that most businesses should see top line and profit growths, while unemployment rate will fall but the level will remain high during the year.

This is even as he pointed out that the projected budget deficit might be lower than earlier envisaged due low implementation of the capital budget.