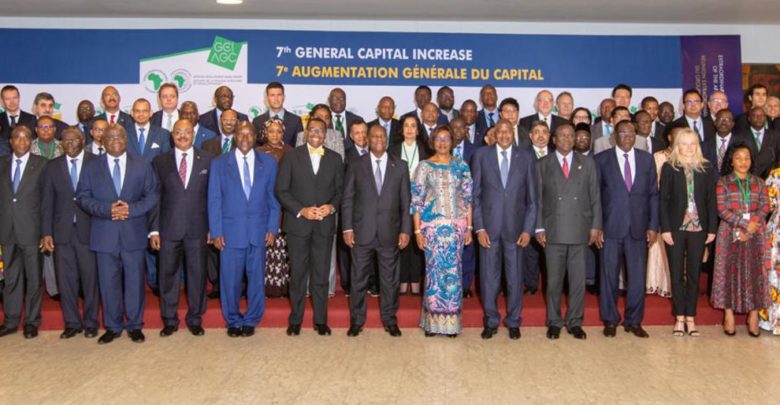

Governors of the African Development Bank, representing shareholders from 80 countries, approved a landmark $115 billion increase in capital for the continent’s foremost financial institution at an extraordinary shareholders’ meeting held Thursday in Abidjan,.the Ivory Coast capital.

The capital increase, the largest in the history of the development finance institution since its establishment in 1964, demonstrated increasing confidence by shareholders in the bank.

With the approved capital increase, the bank’s capital will more than double from $93 billion to $208 billion, thereby solidifying its position as the foremost development financing institution for the continent.

It will also ensure that the bank will continue to maintain a sterling AAA rating, all stable, from the top rating agencies.

Speaking at the opening ceremony, the President of Ivory Coast, Alassane Ouattara said: “the integration of the continent’s priorities into the High 5s indicates that the African Development Bank group is a strategic partner for African governments.”

Commenting on the latest capitalization of the bank, AfDB President, Dr. Akinwumi Adesina, said: “We have achieved a lot, yet there is still a long way to go. Our responsibility is to very quickly help improve the quality of life for the people of Africa.

“This general capital increase represents a very strong commitment of all our shareholders to see better quality projects that will significantly have an impact on the lives of the people in Africa – in cities, in rural communities, and for millions of youth and women

“The Bank will continue its leadership role on infrastructure development, strengthening regional integration, helping to realize the ambitions of the African Continental Free Trade Area, supporting fragile states to build resilience, ensuring sustainable debt management, addressing climate change and boosting private sector investments. We will do a lot more. This is a historic moment.”

“I applaud the shareholders for their strong confidence in the Bank and for boosting support for Africa’s development”, the development finance expert added.

With the latest capital increase, the bank plans to do more in its development finance interventions in the continent and by so doing targets 105 million people to have access to new or improved electricity connections; 244 million people to benefit from improvements in agriculture; 15 million people to benefit from investee projects; 252 million people to benefit from improved access to transport; and 128 million people to benefit from improved access to water and sanitation.

It would be recalled that the bank launched discussions on the request for a general capital increase two years ago, to help fast track the delivery of its ‘High 5’ development strategies, the sustainable development goals and the African Union’s Agenda 2063.

Over the past four years, the bank’s High 5 priorities have delivered tangible results, including helping to connect 16 million people to electricity, 70 million people provided with agricultural technologies to boost food security; 9 million people given access to finance through private sector investee companies; 55 million people provided improved access to transport services; and 31 million people with access to water and sanitation.